Elizabeth Nováček | January 26, 2023 | 9 minutes read

Companies are continually being pressured from multiple sides to raise the bar on their environmental, social, and governance (ESG) standards. But how can they do so effectively? Let’s look closer to home than a faraway carbon offset forest with the smarter use of the resources we have.

What’s in an ESG?

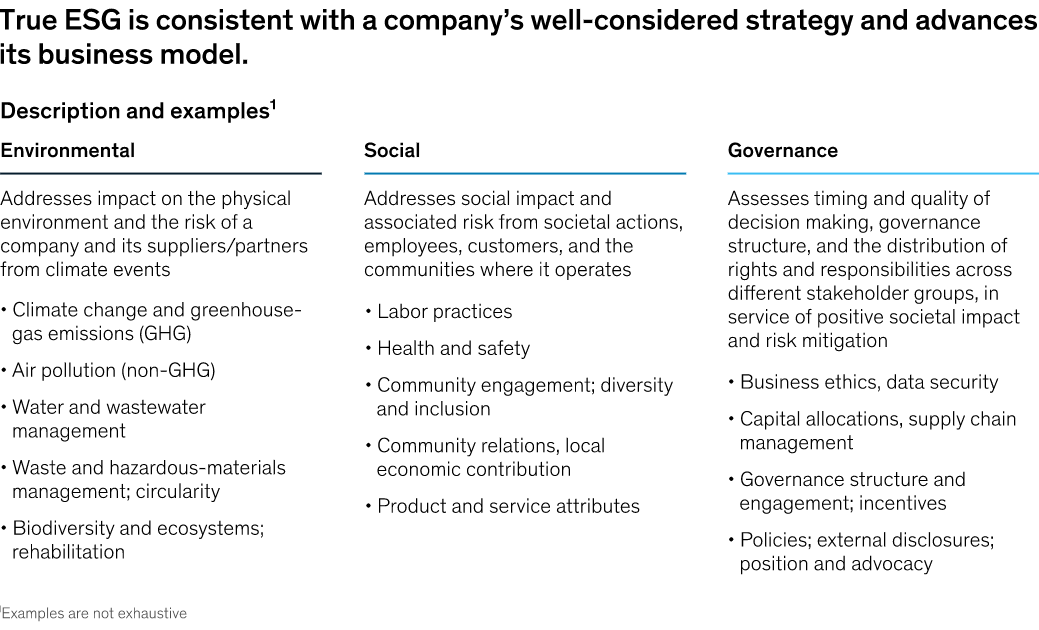

It is all too easy for the word ‘sustainable’ to get lost in a flurry of hype and greenwashing. We see it and its fellow synonyms – ecological, green, environmentally friendly, and so forth – everywhere and that is because there is demand for it everywhere. It is no longer just the Gretas and hippies pushing this. It is also corporate executives whether they like it or not. From their perspective and the perspective of the private sector at large, it is commonly spelled out within ESG, standing for ‘environmental, social, and governance’.

ESG is the new holy trinity that strives to guide a company’s ambitions beyond just financial growth to new, more sustainable horizons for society and the natural environment at large. Today the private sector is being spurred from all sides – investors, policy, market competition, and consumers – to be more sustainable, and in the same stride, the exlusivity of the word is getting more synchronized and measurable clarity and definition among ESG frameworks and standards from all players. From the Big Three Credit Rating Agencies (S&P, Moody's, and Fitch) to the Big Four accounting firms (Deloitte, EY, KPMG, and PwC), ESG is now a front-and-center topic. We see this trend reflected within corporations; a 2022 McKinsey report recorded that 90% of S&P 500 companies now publish ESG reports in some form.

It isn’t just the private sector moving itself in this direction voluntarily. Consumers show a growing demand for environmentally friendly products, with most of the demand being pulled from the younger cohorts who also make up the growing future landscape of consumers. Forrester reported that over half of consumers agree that it’s worth paying more for sustainable or environmentally friendly products in 2022 and in 2021 PwC reported that 83% of consumers think companies should be actively shaping ESG best practices.

Let’s swivel our perspective and look at the policy, governance, and the international governance organization side of things (keep in mind this isn’t tipping our toes into the very important scientific research community that’s the bedrock of all this). The Paris Agreement, driven by the UN, and the EU Green Deal, both commit its members and signees to meet climate change mitigation ambitions, which ripples into both national and municipal governance levels. If a company wants to be relevant and competitive, reporting and considering its ESG is no longer just a nice perk to have.

ESG needs to be in a company’s DNA and can no longer be an add-onGlen Hodgson, CEO of Free Trade Europa

Of course, reporting ESG is a far more nuanced task than reporting financials. Numbers are absolute, they balance or they don’t. Environmental, social and governance standards are qualitative and therefore more complicated to assess by nature. In addition to being a relatively new standard, ESG reporting takes place in a rather fickle landscape and one where competitive companies race through cutting corners to meet KPIs in the most efficient way–this is the competitive nature of an open market after all.

Carbon offsetting

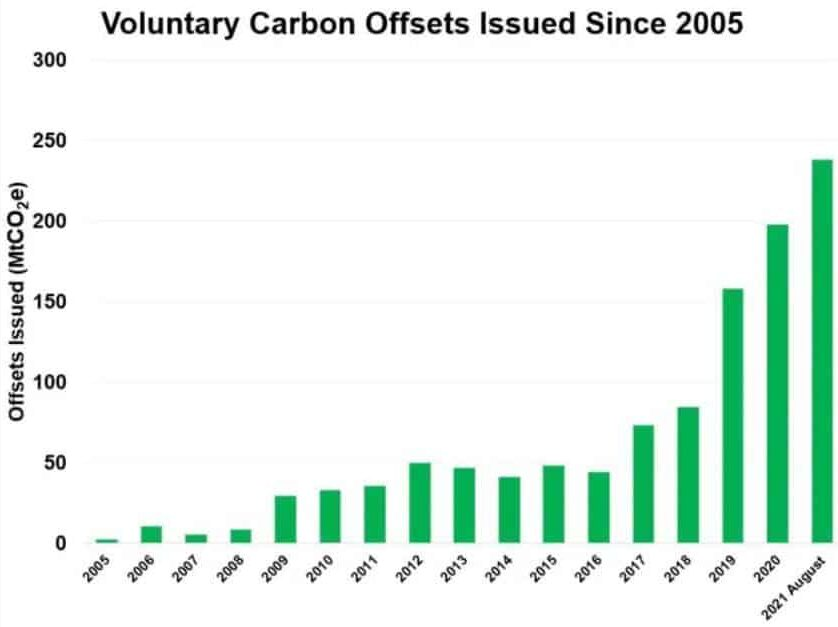

One way for companies to fulfill the E in ESG are carbon offsets: offsetting their internally created carbon emissions by supporting and investing in external projects that reduce carbon emissions, like reforestation or renewable energy projects. The carbon market has existed for a while, with most sources pointing at 1997 when the Kyoto Protocol was signed. Over this time, the carbon offset market has grown, along with third-party agencies that help companies disclose their carbon footprint and verify and certify carbon offsets, like The Carbon Disclosure Project and The Gold Standard, and also within existing organizations like the World Economic Forum and The International Financial Reporting Standards Foundation.

However alongside the growth of this market has come criticism, even with some critics accusing it as a license to pollute. Offset projects have been uncovered as redundant for a range of reasons and complications such as: projects were found to be empty scams, projects were already self-sufficient not needing funding, projects weren’t environmentally viable in the long run, or there was leakage – meaning that that preservation project just moved the problem elsewhere.

Carbon insetting

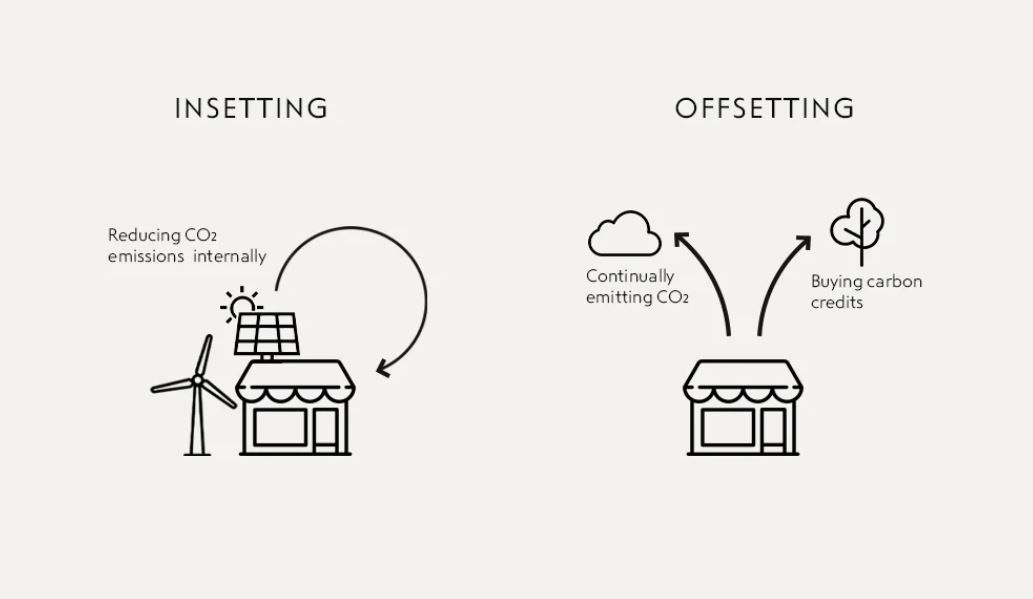

In the grander scheme of empowering the E in ESG, the holes in carbon offsetting mechanisms creates space for evolutions. It’s not often that such a mechanism is born without needing some mended corrections, and so here is one–let’s start shifting carbon offsetting to carbon insetting.

Carbon insetting addresses limiting carbon emissions within a company's operations. This can look like harnessing energy-efficient technologies, reducing its waste with circular economic methods, or adopting more sustainable transportation means within the company’s operations. While it is easier for some industries to reduce their relative environmental impact than others (e.g it’s not possible to put a software company in the same race as a manufacturing company), this should be prioritized over external offsetting.

It may sound overly optimistic to simply swish a sustainability wand and make such sweeping changes, but innovation and technology are rapidly making strides forward to make it more possible. Furthermore, innovation doesn’t always have to reinvent the wheel. It can offer practical solutions to better utilize resources at hand. Such optimization can be understood, organized, and delivered with digitization and data driven optimization which is becoming more readily available.

Targeting transport

Whatever the industry, employee commuting is a good area for companies to target as road commuting makes up one of the largest single contributors to greenhouse gasses. Plus, cars bring a string of other negative externalities such as: noise pollution, parking lots taking up urban space, and congestion putting stress on roads and dampening people’s quality of life.

- Transportation contributes 26% to greenhouse gasses, making it one of the largest contributors (source: Eurostat 2019)

- Cars are the most common way people get to work, more so than other modes like walking or public transport (source: Fleet Europe 2019)

- Out of all the reasons to drive, commuting to work is the most common (source: Eurostat 2022)

Furthermore, cars are seriously underused: the average passengers in a car is 1.4 while the average car is parked 96% of the time. There is space to innovate without stressing expenditure, major risk, or pushing people too far from beyond their comfort zones.

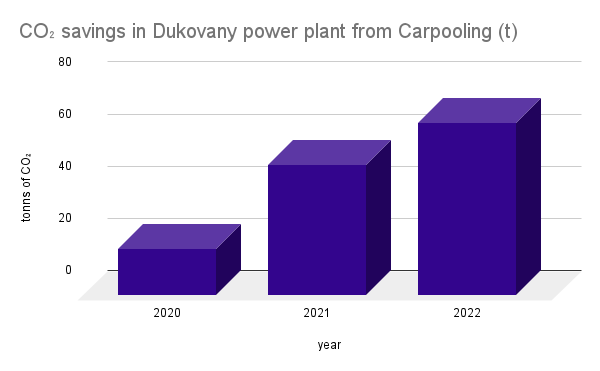

In 2021 ČEZ, Czechia’s leading energy provider, started using the Yedem Carpooling app for its approximately 2,000 employees at the Dukovany Nuclear Power Plant. The app simply enabled its employees to carpool to work, helping employees save on commuting costs, but also reducing the corporation’s carbon emissions by 66,231 kilograms of CO₂ in 2022.

Why should corporations entangle themselves in carbon credit markets and faraway rainforests when such solutions are available within our own tangible grasp? Before we embark on new innovations, let’s look closer to home and better utilize what we have.